For business owners managing payroll, understanding various employment taxes is crucial for compliance. Among the most important is the Federal Unemployment Tax Act (FUTA). Far from being a burden, FUTA is a vital component of the safety net that supports American workers, specifically by funding the system that provides temporary financial assistance to those who have lost their jobs through no fault of their own.

FUTA Defined

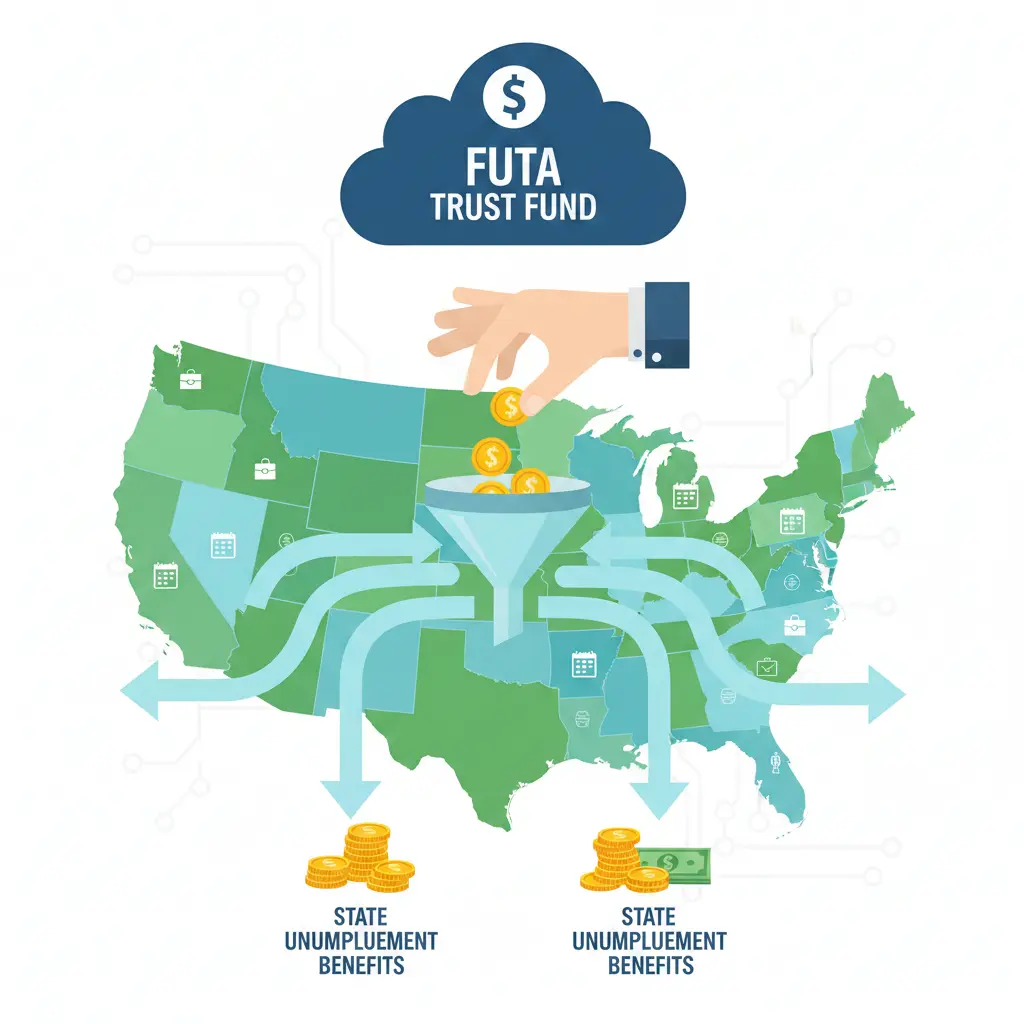

FUTA stands for the Federal Unemployment Tax Act. It is a federal law that requires employers to pay a tax on employee wages. The funds collected through FUTA are used to finance the federal government’s share of unemployment insurance programs, which are administered by the individual states.

In essence, FUTA contributes to a federal trust fund. States can then borrow from this fund if they lack the resources to pay insurance benefits to their residents during times of high unemployment.

FUTA vs. SUTA: How the System Works

Unemployment insurance is a collaborative effort between the federal and state governments:

FUTA (Federal Unemployment Tax Act): This is the tax paid to the federal government. It provides oversight and a financial backstop for the entire system, primarily by funding administrative costs and providing loans to states.

SUTA (State Unemployment Tax Act): This is the tax paid to the individual state. Because each state determines its own benefit and tax structure, SUTA rates, taxable wage bases, and eligibility rules can vary widely. SUTA is the primary funding source for the direct benefits paid out to unemployed workers.

Employers generally pay both FUTA and SUTA taxes. The two acts work together to ensure the stability of the unemployment insurance program nationwide.

Who Pays FUTA Taxes?

A key distinction of FUTA is that only employers pay the tax. Unlike the Federal Insurance Contributions Act (FICA), which includes Social Security and Medicare and requires contributions from both the employer and the employee, employees do not have FUTA tax withheld from their wages.

Most employers are subject to FUTA unless they meet specific exemption criteria outlined in the IRS general test, which generally exempts:

Employers who paid less than $1,500 in total wages during any calendar quarter of the current or previous year.

Employers who did not employ any people for at least some part of a day in any 20 or more different weeks during the current or previous year.

Nonprofit organizations that are tax-exempt under Internal Revenue Code (IRC) section 501(c)(3).

The FUTA Tax Rate and Credit

The standard FUTA tax rate is 6.0% on the first $7,000 of wages paid to each employee annually.

However, most employers are eligible for a credit of up to 5.4% against this federal tax. This credit is granted for timely payment of their state unemployment taxes (SUTA).

For employers who receive the full credit, the effective FUTA tax rate is reduced to 0.6% (6.0% – 5.4% = 0.6%). This means the maximum FUTA liability per employee in a year is often just $42 ($7,000 x 0.006).

Credit Reduction States

Employers in a “credit reduction state” may not be eligible for the full 5.4% credit. A credit reduction state is one that has borrowed from the FUTA trust fund to pay unemployment benefits and has not repaid the loan by a specific date. Employers in these states typically have to pay an additional federal unemployment tax when filing their annual return.

FUTA Frequently Asked Questions (FAQs)

1. When are FUTA taxes due?

FUTA taxes are due quarterly. If an employer’s total FUTA tax liability exceeds $500 in a single quarter, the payment is due by the last day of the month following the end of the quarter. If the cumulative liability is less than $500, the balance is carried forward until it reaches the $500 threshold or until the annual filing deadline.

2. How do I report FUTA tax?

FUTA tax is reported annually using IRS Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. The general filing deadline is January 31 of the following year, though an extension may be available if all taxes were paid on time throughout the year.

3. What is the difference between FUTA and FICA?

| Feature | FUTA (Federal Unemployment Tax Act) | FICA (Federal Insurance Contributions Act) |

| Purpose | Funds unemployment insurance programs. | Funds Social Security and Medicare. |

| Payer | Employer only. | Employer and Employee (shared liability). |

| Reporting Form | Form 940 (Annual). | Form 941 (Quarterly). |

4. Do the self-employed pay FUTA?

Generally, no. Sole proprietors are not considered employees of their own business and therefore do not pay federal unemployment tax because they are not contributing to the system for themselves. Only employers with actual employees are subject to FUTA.

5. Are household employees subject to FUTA?

Employers of household employees (like nannies or maids) are subject to FUTA if they pay total cash wages of $1,000 or more to any household employee in any calendar quarter of the tax year. The household employee themselves does not pay the tax.

6. How is my FUTA tax rate calculated?

Your FUTA tax is calculated on the first $7,000 of wages paid to each employee. The effective rate is typically 0.6% (due to the 5.4% state tax credit) unless you operate in a state subject to a FUTA credit reduction.

Reads Also: Unlocking Savings: A Deep Dive into LifeMart Employee Discounts