Calculating your take-home pay in Florida can seem straightforward at first glance, but understanding all the deductions and tax implications requires careful consideration. Whether you’re a new employee, considering a job offer, or simply want to better understand your paycheck, a Florida paycheck calculator is an invaluable tool that helps you determine exactly how much money you’ll receive after taxes and other deductions.

Understanding Florida Tax Advantage

One of the most significant advantages of working in Florida is the state’s tax structure. Florida is one of only nine states in the United States that does not impose a state income tax on its residents. This means that Florida workers keep more of their gross income compared to employees in states with high income tax rates like California or New York.

However, the absence of state income tax doesn’t mean Florida employees are exempt from all taxes. Federal income taxes, Social Security taxes, Medicare taxes, and various other deductions still apply to Florida paychecks. Understanding these components is crucial for accurate paycheck calculations.

Components of Your Florida Paycheck

Federal Income Tax

The federal government imposes income tax on all U.S. workers, regardless of their state of residence. The amount deducted depends on several factors including your gross income, filing status, number of dependents, and the information you provided on your W-4 form. Federal income tax rates are progressive, meaning higher earners pay higher percentages on portions of their income.

Social Security Tax

Social Security tax is deducted at a flat rate of 6.2% on wages up to the annual Social Security wage base, which adjusts yearly for inflation. For 2024, this wage base is $160,200, meaning you won’t pay Social Security tax on income above this threshold.

Medicare Tax

Medicare tax is deducted at 1.45% on all wages with no income limit. High earners (individuals making over $200,000 or married couples filing jointly making over $250,000) pay an additional 0.9% Medicare surtax on income above these thresholds.

State Disability Insurance and Unemployment Tax

While Florida doesn’t have state income tax, employees may still see small deductions for state disability insurance in certain circumstances, though this is less common than in other states. Florida employers pay unemployment taxes, but these typically don’t appear as employee deductions.

Pre-Tax and Post-Tax Deductions

Beyond taxes, your Florida paycheck may include various pre-tax and post-tax deductions that affect your take-home pay.

Pre-Tax Deductions

Pre-tax deductions reduce your taxable income, which can lower your overall tax burden. Common pre-tax deductions include:

- Health insurance premiums

- Dental and vision insurance

- Retirement plan contributions (401k, 403b)

- Flexible Spending Account (FSA) contributions

- Health Savings Account (HSA) contributions

- Transit and parking benefits

- Life insurance premiums (up to $50,000 coverage)

Post-Tax Deductions

Post-tax deductions are taken from your income after taxes have been calculated and don’t reduce your taxable income. These may include:

- Roth retirement account contributions

- Union dues

- Charitable contributions through payroll deduction

- Life insurance premiums over $50,000

- Disability insurance premiums

- Garnishments or wage attachments

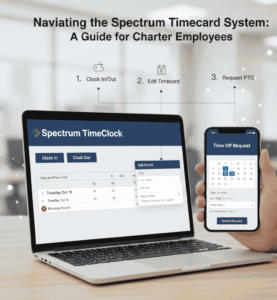

How Florida Paycheck Calculators Work?

Florida paycheck calculators use current tax tables and rates to estimate your take-home pay. These tools typically require you to input:

Basic Information

- Gross salary or hourly wage

- Pay frequency (weekly, bi-weekly, semi-monthly, monthly)

- Filing status (single, married filing jointly, married filing separately, head of household)

- Number of allowances or dependents

Additional Details

- Pre-tax deductions amounts

- Post-tax deduction amounts

- Additional federal tax withholding

- Overtime hours and rates

- Bonus or commission amounts

The calculator then applies current federal tax brackets, Social Security and Medicare rates, and accounts for your specified deductions to provide an estimate of your net pay.

Benefits of Using a Paycheck Calculator

Budgeting and Financial Planning

Understanding your exact take-home pay helps you create realistic budgets and financial plans. You can determine how much money you’ll have available for expenses, savings, and discretionary spending.

Job Offer Evaluation

When considering job offers, a paycheck calculator helps you compare the actual take-home pay rather than just gross salaries. A higher gross salary in a state with income tax might result in lower net pay than a slightly lower salary in Florida.

Tax Planning

Paycheck calculators help you understand how changes in withholdings, deductions, or income levels affect your take-home pay. This information is valuable for tax planning and ensuring you’re not over or under-withholding federal taxes.

Retirement Planning

By modeling different contribution levels to retirement accounts, you can see how increasing your savings affects your current take-home pay and plan accordingly.

Common Calculation Mistakes to Avoid

Not Updating for Life Changes

Life events like marriage, divorce, having children, or buying a home can significantly impact your tax situation. Remember to update your W-4 form and recalculate your take-home pay after major life changes.

Forgetting About Overtime

If you regularly work overtime, ensure your calculations include overtime pay, which is typically calculated at time-and-a-half for hours worked over 40 in a week.

Overlooking Annual Limits

Some deductions have annual limits. For example, Social Security tax stops being deducted once you reach the wage base limit, which can result in higher take-home pay later in the year for high earners.

Ignoring Bonus Tax Treatment

Bonuses and supplemental wages are often subject to different withholding rates than regular wages, which can affect your take-home pay calculations.

Maximizing Your Take-Home Pay in Florida

Optimize Pre-Tax Deductions

Take advantage of pre-tax deductions like health insurance, retirement contributions, and FSA accounts to reduce your taxable income and increase your take-home pay.

Review Your W-4 Regularly

Ensure your W-4 form accurately reflects your current situation to avoid over or under-withholding federal taxes. Over-withholding gives the government an interest-free loan, while under-withholding can result in penalties.

Consider HSA Contributions

Health Savings Accounts offer triple tax benefits: deductions reduce current taxable income, growth is tax-free, and withdrawals for qualified medical expenses are tax-free.

Plan for the Tax-Free Advantage

Florida’s lack of state income tax means you can potentially save or invest the money that would otherwise go to state taxes, giving you a significant advantage in building wealth over time.

Special Considerations for Florida Workers

Seasonal Employment

Florida’s tourism industry creates many seasonal jobs. If you work seasonally, your tax withholdings might not align perfectly with your annual tax liability, making accurate calculations more important for planning.

Multiple Jobs

If you work multiple jobs in Florida, ensure your tax withholdings across all positions are adequate. The IRS provides worksheets to help calculate proper withholdings for multiple job situations.

Remote Work

With the rise of remote work, some Florida residents work for companies based in other states. Generally, you’ll follow Florida tax rules (no state income tax), but there may be exceptions depending on your employer’s location and policies.

Choosing the Right Calculator

When selecting a Florida paycheck calculator, look for tools that:

- Use current tax rates and brackets

- Allow for detailed deduction inputs

- Provide both annual and per-paycheck calculations

- Include overtime and bonus calculations

- Offer multiple pay frequency options

Popular options include calculators from major payroll companies, financial websites, and government resources. Always verify that the calculator you’re using reflects the most current tax laws and rates.

Conclusion:

Understanding your Florida paycheck through accurate calculations empowers you to make informed financial decisions. Florida tax-friendly environment provides a significant advantage, but maximizing this benefit requires understanding all the components that affect your take-home pay. Regular use of paycheck calculators, combined with smart financial planning, helps ensure you’re making the most of your earnings in the Sunshine State.

Whether you’re budgeting for daily expenses, evaluating job opportunities, or planning for retirement, a thorough understanding of your paycheck calculations forms the foundation of sound financial management. Take advantage of Florida’s tax benefits while staying informed about federal obligations to optimize your financial situation.