If you have ever started a new job or experienced a major life change, you’ve probably encountered the W-4 form. This seemingly simple IRS document can feel surprisingly confusing, and filling it out incorrectly can lead to an unwelcome surprise at tax time—either a hefty tax bill or realizing you’ve been giving the government an interest-free loan all year.

Let’s break down everything you need to know about the W-4 form in 2025, so you can fill it out with confidence and optimize your paycheck.

What Is a W-4 Form?

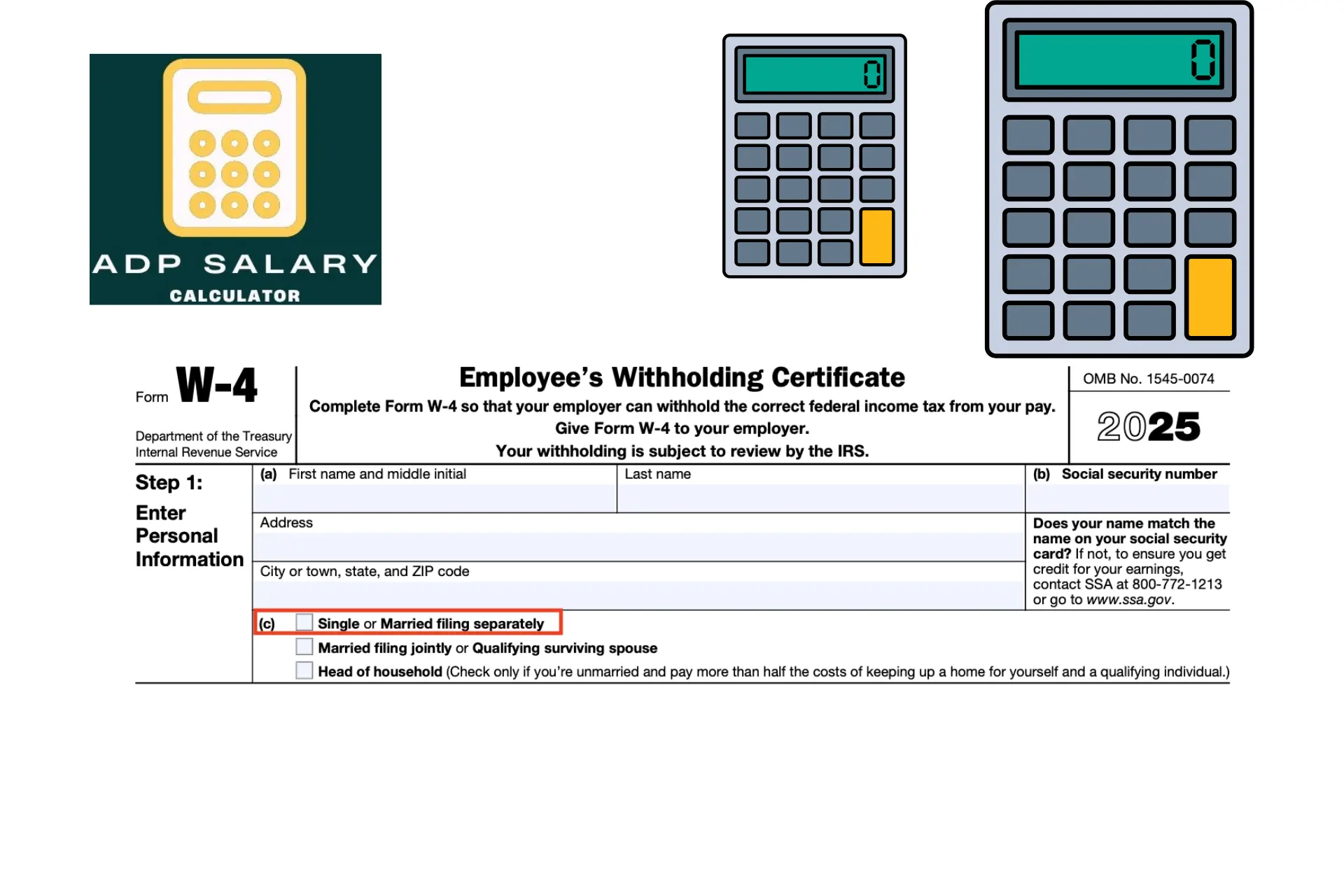

The W-4, officially called the “Employee’s Withholding Certificate,” tells your employer how much federal income tax to withhold from your paycheck. Think of it as instructions you’re giving to your payroll department about how much of your earnings should go to the IRS before you ever see the money.

The form underwent a major redesign in 2020, eliminating the confusing “allowances” system that left many people scratching their heads. The current version is more straightforward, though it still requires some thought and basic information about your financial situation.

When Should You Fill Out a W-4?

You’ll need to complete a W-4 form when:

- Starting a new job – Your employer will ask you to fill one out during onboarding

- Getting married or divorced – Major relationship changes affect your tax situation

- Having or adopting a child – Dependents significantly impact your taxes

- Starting or stopping a second job – Multiple income sources change your withholding needs

- Receiving a large tax refund or owing taxes – This signals your withholding needs adjustment

Many people fill out their W-4 once and forget about it. However, reviewing it annually or after any major life change is smart financial planning.

Understanding the Five Steps of the 2025 W-4

The current W-4 consists of five steps, but here’s the good news: only Step 1 is required for everyone. Steps 2 through 5 are optional and only apply if you have specific circumstances.

Step 1: Enter Personal Information

This section is straightforward. You’ll provide:

- Your full name and Social Security number

- Your home address

- Your filing status (Single, Married Filing Jointly, Married Filing Separately, or Head of Household)

Important tip: Your filing status should match what you plan to use on your actual tax return. If you’re married but plan to file separately, choose “Married Filing Separately.” Getting this wrong can throw off your entire withholding calculation.

Step 2: Multiple Jobs or Spouse Works

Skip this step if you have only one job and are single. However, if you work multiple jobs or are married and both spouses work, this step is crucial.

You have three options here:

Option A: Use the IRS online estimator – The most accurate method. The IRS Tax Withholding Estimator tool at IRS.gov walks you through your situation and provides specific numbers to enter on your W-4.

Option B: Use the Multiple Jobs Worksheet – Found on page 3 of the W-4 form, this worksheet helps you calculate the right amount manually. It’s more work but doesn’t require internet access.

Option C: Check the box – If you have only two jobs total (including your spouse’s job), and the pay is similar, you can simply check the box in Step 2(c). This is the easiest option but the least precise.

Why does this matter? The U.S. has a progressive tax system with tax brackets. If you have two jobs each paying $40,000, you’re not taxed as if you earn $40,000 twice—you’re taxed on $80,000 total. Without adjusting, both employers might withhold as if you’re in a lower bracket, leaving you with a tax bill in April.

Step 3: Claim Dependents

This is where you account for the Child Tax Credit and Credit for Other Dependents.

If your total income will be under $200,000 (or $400,000 if married filing jointly), you can claim:

- $2,000 per qualifying child under age 17

- $500 per other dependent (like elderly parents or children over 17)

Multiply the number of qualifying children by $2,000 and add $500 for each other dependent, then enter the total.

Example: You have two children under 17 and support your elderly mother. Your calculation would be: (2 × $2,000) + (1 × $500) = $4,500.

If your income exceeds these thresholds, you’ll need to use the IRS worksheet to calculate a reduced credit amount.

Step 4: Other Adjustments (Optional)

This section has three parts for fine-tuning your withholding:

Part A: Other Income – Have income from interest, dividends, retirement accounts, or a side business? Enter the estimated annual amount here. Your employer will withhold extra to cover the tax on this income.

Part B: Deductions – If you plan to claim deductions beyond the standard deduction (like mortgage interest, charitable donations, or student loan interest), enter your estimated annual amount. This reduces your withholding since you’ll owe less tax.

Part C: Extra Withholding – Want to withhold an extra $50, $100, or any amount from each paycheck? Enter it here. This is perfect if you’d rather get a refund than risk owing taxes, or if you’re self-employed on the side and want to cover estimated taxes through withholding.

Step 5: Sign and Date

Don’t forget this step! An unsigned W-4 isn’t valid. Your employer needs your signature and the date to process the form.

Common Mistakes to Avoid

Mistake #1: Claiming “Exempt” – Writing “Exempt” in Step 4(c) means NO federal tax will be withheld. This is only appropriate if you had no tax liability last year and expect none this year. Most people don’t qualify, and claiming exempt incorrectly can result in penalties.

Mistake #2: Not updating after life changes – Got married in June? Had a baby in September? Don’t wait until next year to update your W-4. Submit a new one as soon as possible to adjust your withholding for the rest of the year.

Mistake #3: Ignoring multiple jobs – If you work two jobs and fill out the basic W-4 for both without completing Step 2, you’ll almost certainly underwithhold and owe money at tax time.

Mistake #4: Confusing the old and new forms – If you remember claiming “0” or “1” allowances, forget that system. The new W-4 doesn’t work that way. Don’t try to translate old allowances into the new form.

How to Check If Your Withholding Is Correct

After submitting your W-4, wait for your first paycheck and review the federal tax withholding amount. Does it seem reasonable?

A general rule of thumb: Your federal withholding should be roughly 10-15% of your gross pay for most middle-income earners, though this varies significantly based on your situation.

Use the IRS Tax Withholding Estimator periodically throughout the year, especially after:

- Getting a raise

- Changes in deductions or credits

- Market changes affecting investment income

Getting a huge refund might feel like a windfall, but remember—that’s your money the government held onto all year without paying you interest. On the flip side, owing thousands at tax time can strain your budget and potentially trigger penalties.

Special Situations

Freelancers and contractors: If you’re a W-2 employee but also do freelance work, use Step 4(a) to have extra tax withheld to cover your self-employment income, or make quarterly estimated tax payments separately.

Pension or Social Security: Receiving retirement income alongside wages? You may want to have taxes withheld from your pension or Social Security (using Form W-4P or W-4V) rather than adjusting your W-4, or vice versa.

Non-resident aliens: If you’re a foreign national working in the U.S., special withholding rules may apply. Consult with a tax professional familiar with international tax law.

The Bottom Line:

The W-4 form isn’t something to rush through during new hire paperwork or ignore for years. Taking 15 minutes to fill it out thoughtfully can save you from an unpleasant surprise when you file your taxes.

Remember, there’s no perfect withholding amount—it depends on whether you prefer slightly larger paychecks throughout the year or a refund when you file. The key is understanding your options and making an informed choice rather than leaving it to chance.

When in doubt, the IRS Tax Withholding Estimator is your best friend, and updating your W-4 is as simple as submitting a new form to your HR department. Your future self will thank you for getting it right.